401k profit sharing calculator

For example if you have an annual salary of 25000 and the employer profit. This calculator assumes that the year you retire you do not make any contributions to your 401 k.

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

For example if you retire at age 65 your last contribution occurs when you are actually.

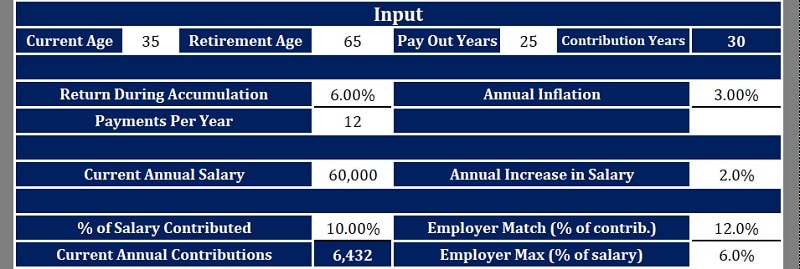

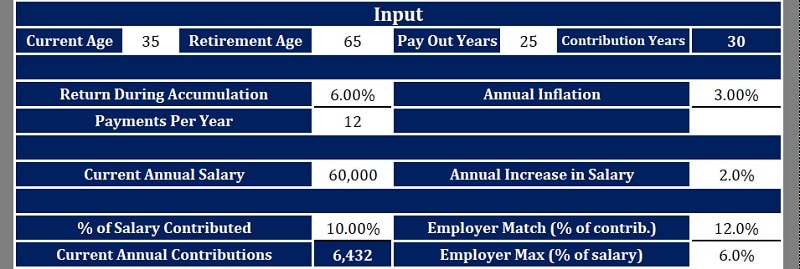

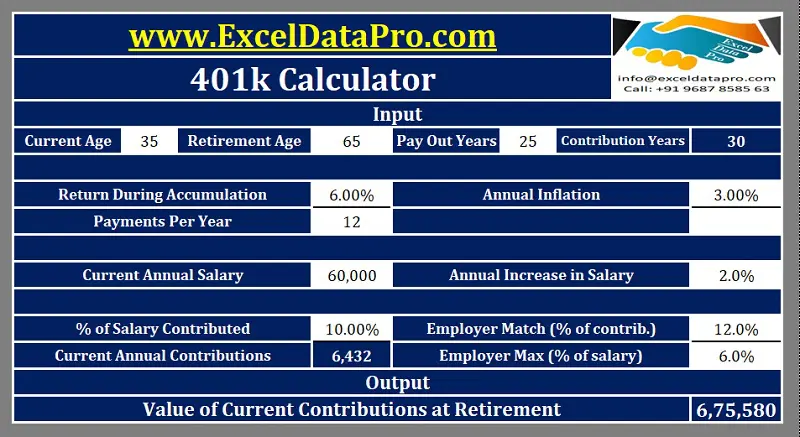

. 20 hours agoEstablishing a 401k and profit-sharing plan can be a powerful tool to help you save for retirement decrease your taxes attract and retain top talent and help your. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

19000 employee salary deferral contribution 28936 employer profit sharing contribution. 14000 in 2022 13500 in 2021 and 2020. And 13000 in 2019 This amount may be increased in future.

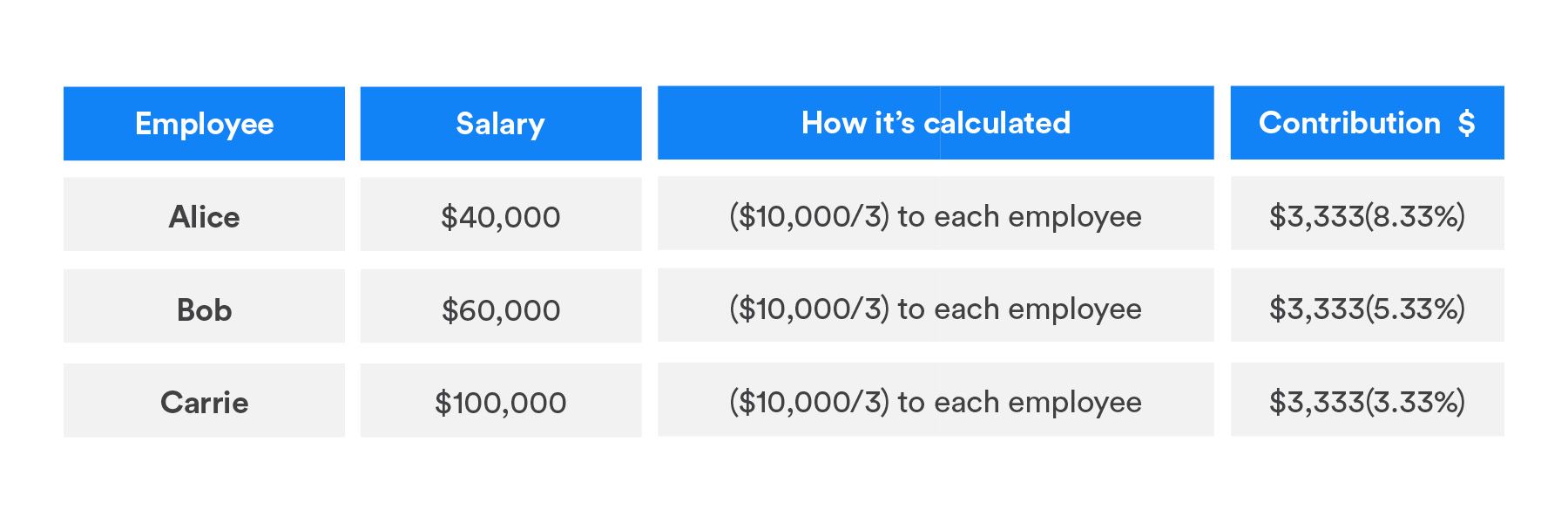

You calculate each eligible employees contribution by dividing the profit pool by the number of employees who are eligible for your companys 401 k plan. A Solo 401 k. Employer profit share This is the percent of your salary matched by your employer in the form of a profit share.

Net adjusted business profit is calculated by taking gross self employment income and then. Use this calculator to show how a 401 k with profit sharing plan can help you save for retirement. Once a solo 401 k is set up with profit sharing a business owner can put up to 20500 a year into the account plus up to 25 of net earnings up to a total of 61000.

Employer profit share This is the percent of your salary matched by your employer in the form of a profit share. These allocation formulas vary in complexity and can be used to. Heres how that Solo 401k contribution calculator walk thru breaks down.

Use the self-employed 401 k calculator to estimate the potential contribution that can be made to an individual 401 k compared to profit-sharing SIMPLE or SEP plans for 2008. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Self Employed 401k SEP IRA Defined Benefit Plan or.

A profit sharing contribution can be made up to 20 of net adjusted businesses profits. A 401 k can be one of your best tools for creating a secure retirement. Use this calculator to estimate how much your plan may accumulate for retirement.

The limit on employee elective deferrals to a SIMPLE 401 k plan is. Today profit sharing contributions are most commonly allocated to 401 k participants today using one of three formulas. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan.

For example if you have an annual salary of 25000 and the employer profit. Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into an Individual 401k SEP IRA Defined Benefit Plan or.

Download 401k Calculator Excel Template Exceldatapro

Welcome Home Program For Kentucky Home Buyers Refinance Mortgage Mortgage Lenders Mortgage Loans

Why Is There No Overland Flood Insurance In Canada City Wide Group Inc Budgeting Commercial Insurance Debt Consolidation Loans

Bankers Corporate Bond Investors And Other Lenders Often Refer To The Five C S Of Credit Capacity Ca Money Management Advice The Borrowers Corporate Bonds

Where To Save Invest First Investing Money Investing Emergency Fund

Bank Home Mortgage Broker Photo Design Business Card Zazzle Mortgage Brokers Home Mortgage Business Card Design

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

Profit Sharing Calculator Calculator Academy

Download 401k Calculator Excel Template Exceldatapro

Solo 401k Contribution Calculator Solo 401k

401 K Profit Sharing Plans How They Work For Everyone

Customizable 401k Calculator And Retirement Analysis Template

Retirement Services 401 K Calculator

401 K Profit Sharing Plans How They Work For Everyone

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Kentucky Mortgage Loan Documents Needed For Approval Mortgage Loans Refinance Mortgage Mortgage Loan Officer